By: Hayley Richards

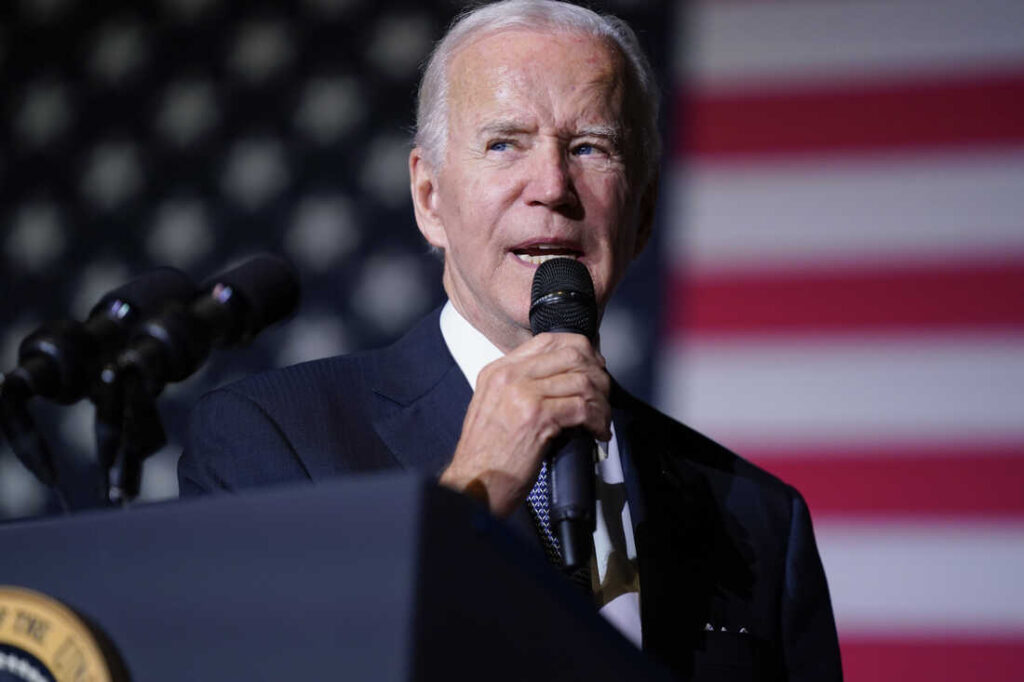

MONTGOMERY, Ala. – President Joe Biden’s student loan forgiveness program has recently sparked a debate. Three months ago According to NPR reporter Sequoia Carrillo, Biden has announced plans to forgive up to $20,000 in federal student loan debt for Pell Grant recipients, and up to $10,000 for others who qualify. On Auburn University Montgomery’s campus, students and staff have mixed opinions about Biden’s plan.

According to the Council On Foreign Relations, though the benefits of a college education outweigh the costs in most cases, many graduates are concerned about entering a weak job market and worry that lingering debt could hinder their financial futures. The CFR is a nonpartisan think tank for government officials, business executives, journalists, educators and citizens in order to help them better understand the world and the foreign policy choices facing the United States. Those who qualify for loan forgiveness will have extra spending money that will allow them to make purchases such as a car and a house, and the extra money will be set aside for their children’s education.

AUM Director of Warhawks Dr. Paul Fox is not against the forgiveness program but is interested to see what legislative decisions Congress will make about the new plan. Freshman Ramonita Velez was initially excited to hear about the loan forgiveness program, and so was her mother. Velez said, “My mother is a teacher who has not been able to retire in an effort to pay off her student loans.” Her mother views the program as a light at the end of the tunnel.

Senior Jebrunski Johnson says, “I will take all the help I can get” from President Biden’s program. Johnson feels that colleges and universities nickel and dime students, and it is about time they receive something in return. Business major Bradley Turner admits he is skeptical of the future consequences of accepting the loan forgiveness but needs the help. Turner states, “Working full-time and going to school will get the best of you. I commute from Auburn every day. Gas is not cheap, and neither is college. I need the help I can get.”

CNBC News reporter Lori Konish reported two months ago that forgiving loans would transfer millions of dollars in debt to the government and its taxpayers. Taxpayers have speculated that their hard-earned money will be used to pay back the loan forgiveness regardless of whether they attended college. People chose not to go to college because they could not afford it, and now it is being paid off for those who struggled to attend.

Senior Cameron Grant says he will be signing up for the forgiveness program. Grant states, “It’s hard not to be a little skeptical of the supposed free money. Times are tough, the economy is struggling and so is everyone else. All we can do is pray nothing bad comes about it in the future.” Freshman Tiana Collins admits she has no current student loans, but if she did, she would be signing up for President Biden’s program. Collins states, “My parents went to college, but they joined the military just so they could receive financial assistance. They are happy for the students now receiving aid from the government instead of having to go into the military if they do not want to.” Theatre major Carter Brown has no current student loans. Brown states, “I am lucky enough to have parents that pay my tuition. If something ever happened and they could no longer help, I am not against signing up.”

According to a recent report from NPR reporter Cory Turner, the Biden administration has said repeatedly its debt relief application would be available in early October. In a call with reporters, senior administration officials dropped the “early” but promised, “We will make the form available in October,” and said they are “working hard to make sure the form can handle the traffic we anticipate.” Majority rules that AUM students are in favor and will be applying for student loan forgiveness. For more information on receiving federal student aid, visit the U.S. Department of Education’s Federal Student Aid website at https://studentaid.gov/debt-relief/application.